Irs Mileage Reimbursement Form 2025. The irs has set the company mileage reimbursement rate for 2025 at 67 cents per mile. 17 rows find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.

The irs has announced the new standard mileage rates for 2025. What are the irs standard mileage rates.

Irs Mileage 2025 Reimbursement Rate 2025 Heda Rachel, The 2025 irs standard mileage rates are 67 cents per mile for every business mile driven, 14 cents per mile for charity and 21 cents per mile for moving or medical. Here is what you need to know about the current irs mileage reimbursement rate in 2025 and 2025 and what you can expect from the irs this year.

Irs Mileage 2025 Reimbursement Rate Velma, This notice provides the optional 2025 standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for business,. The irs announces mileage reimbursement rates for 2025.

Irs Mileage Reimbursement 2025 Announcement Lucie Robenia, The 2025 mileage rate was 65.5 cents per mile driven for business use. 67 cents per mile for business purposes.

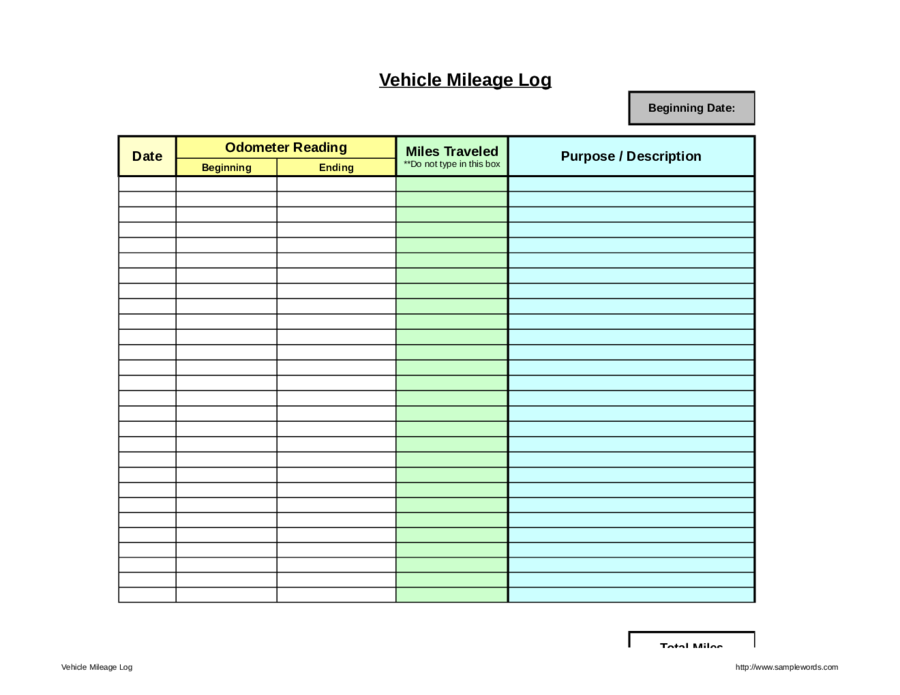

2025 Mileage Reimbursement Rate Matti Shelley, Ensure compliance with our guide. Here is what you need to know about the current irs mileage reimbursement rate in 2025 and 2025 and what you can expect from the irs this year.

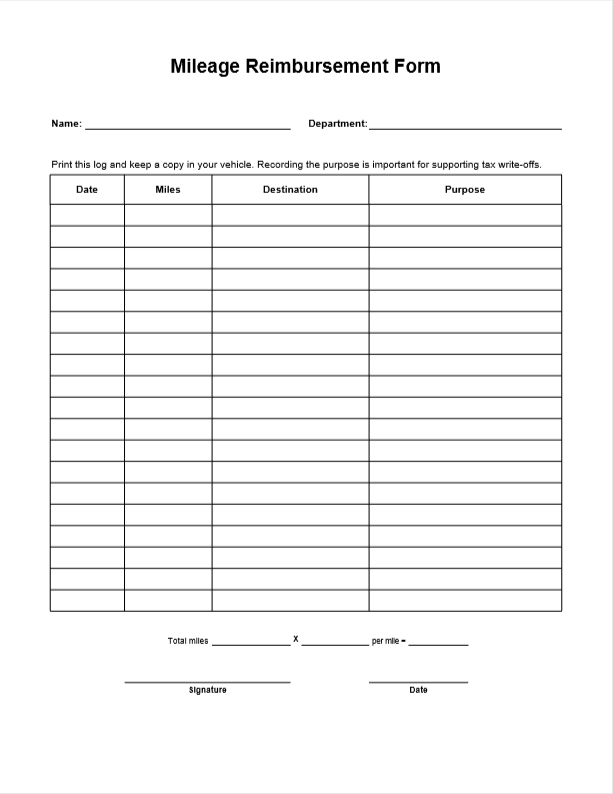

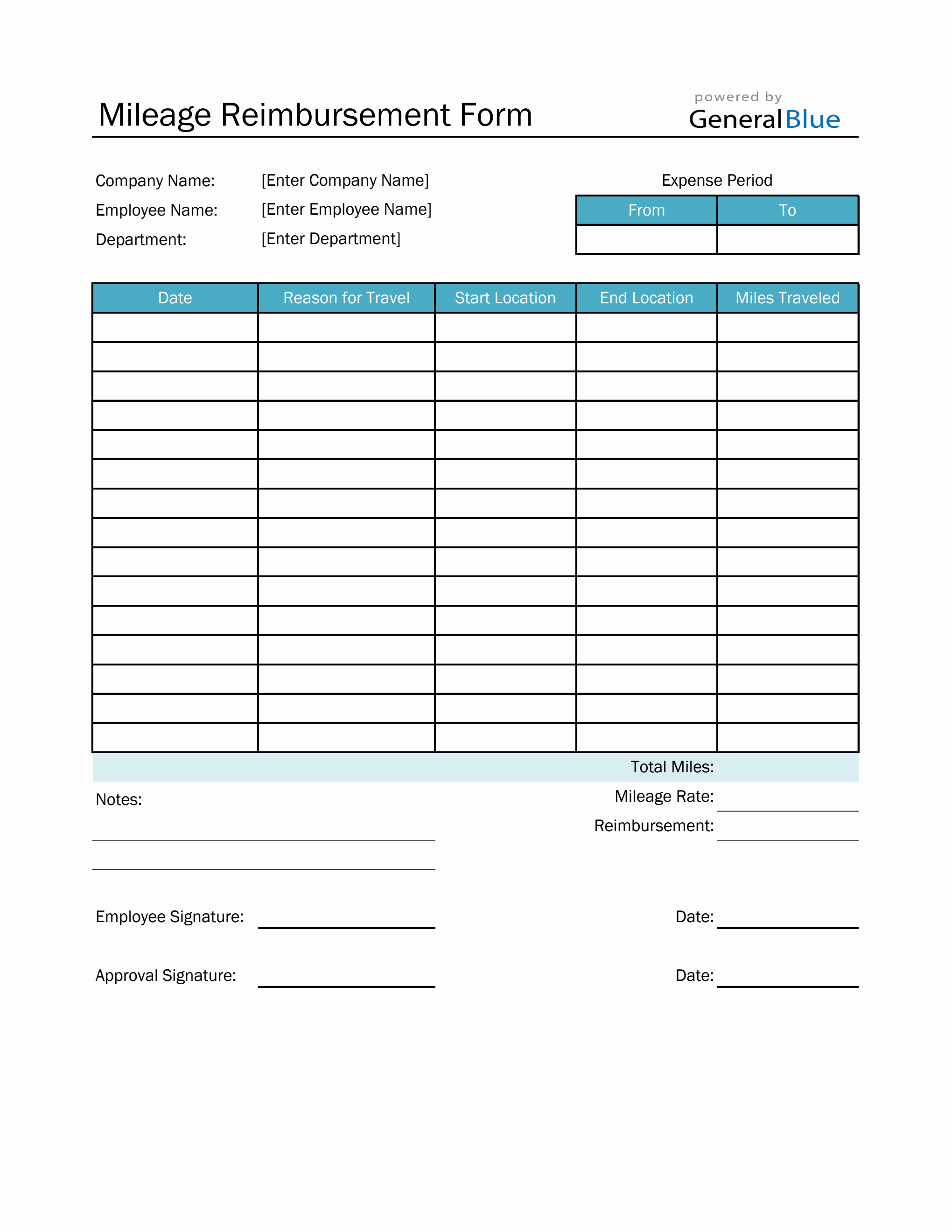

Mileage Reimbursement Form Edit Forms Online PDFFormPro, Learn how mileage reimbursement works in 2025. Learn tips and best practices for employee mileage reimbursement, including the irs standard mileage rate for 2025 and how to manage mileage.

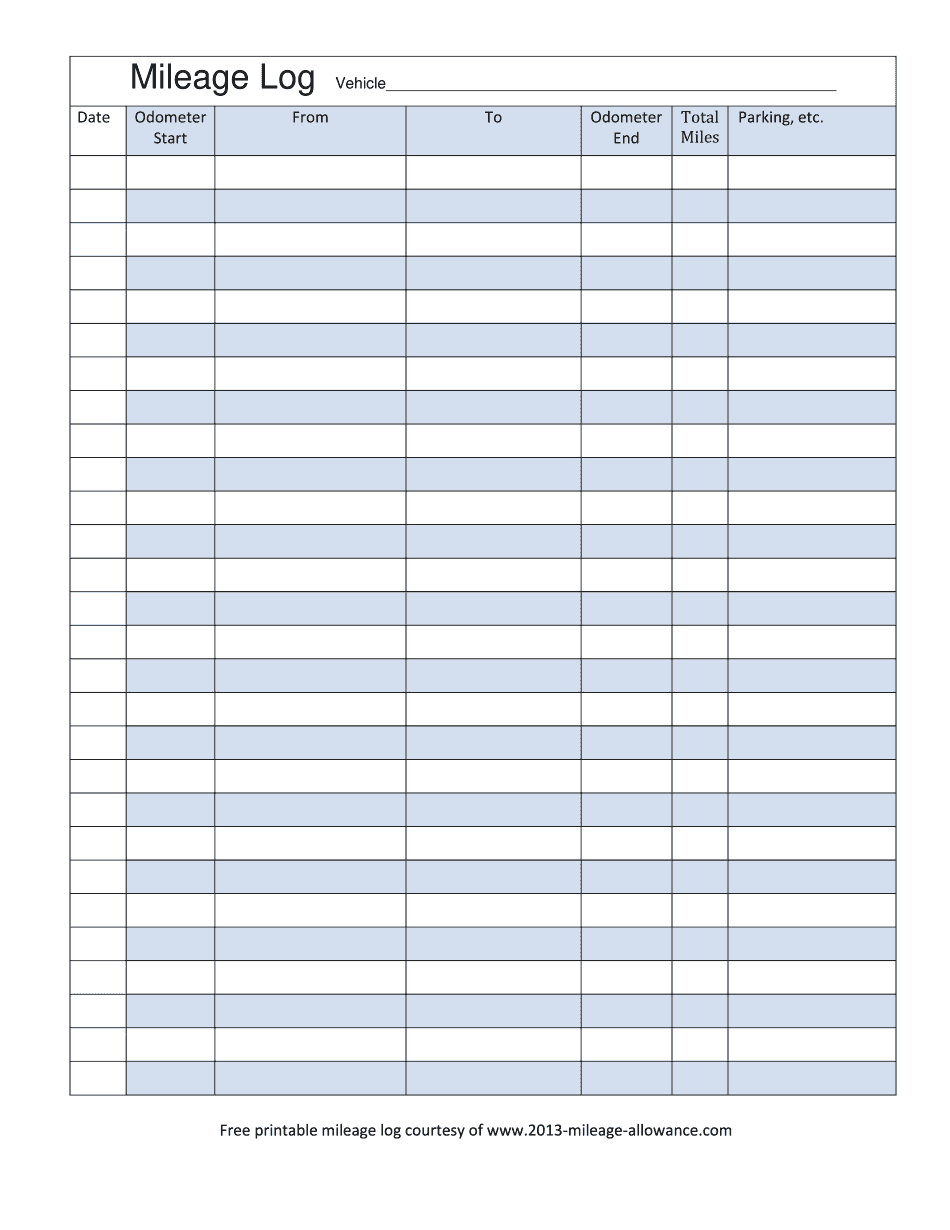

2025 Irs Mileage Reimbursement Rates Dina Myrtia, Learn how to organize, store, and maximize the potential. Ensure compliance with our guide.

2025 Federal Mileage Allowance Dode Nadean, 67 cents per mile for business purposes. The 2025 irs standard mileage rates are 67 cents per mile for every business mile driven, 14 cents per mile for charity and 21 cents per mile for moving or medical.

2025 Mileage Reimbursement Rates Jessa Luciana, Here’s how irs rules impact mileage rate and reimbursement for your employees and what it means for your taxes. The standard mileage rate will increase to 67¢ per mile for business miles driven beginning.

How Much Is Mileage Reimbursement For 2025 Deny, 17 rows find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes. What are the irs standard mileage rates.

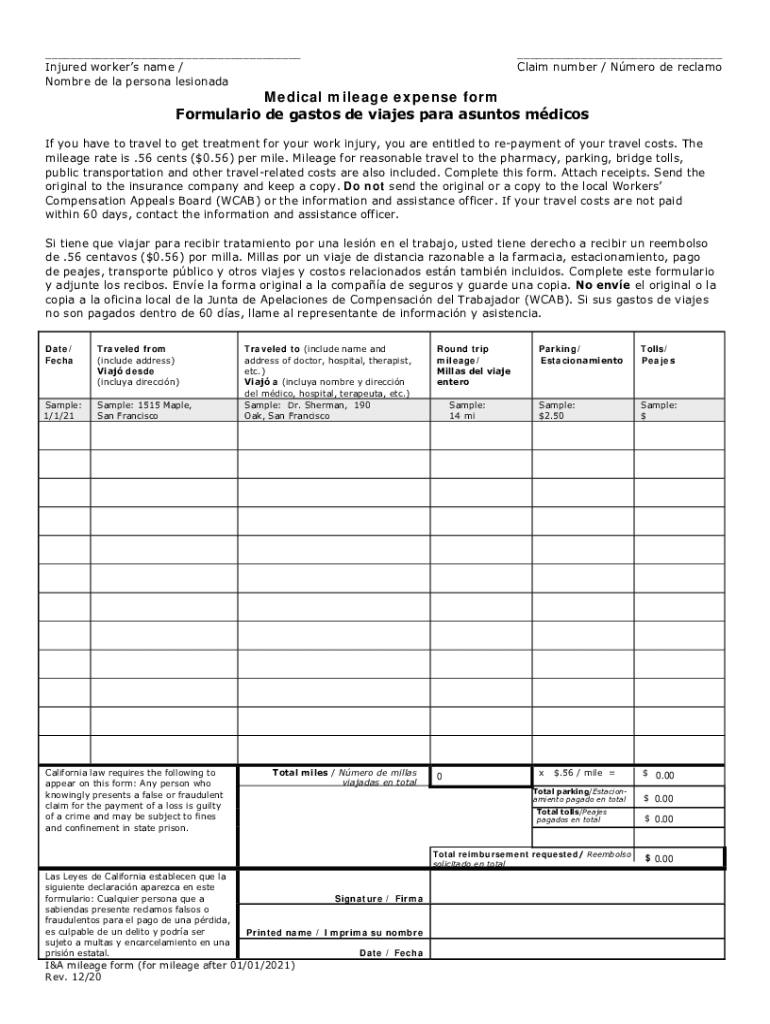

20202024 CA I&A mileage Form El formulario se puede rellenar en línea, What are the irs standard mileage rates. Here’s how irs rules impact mileage rate and reimbursement for your employees and what it means for your taxes.

The 2025 mileage reimbursement rate for business was 65.5 cents per mile, 22 cents for medical and moving miles, and 14 cents for miles in the service of.